At a glance

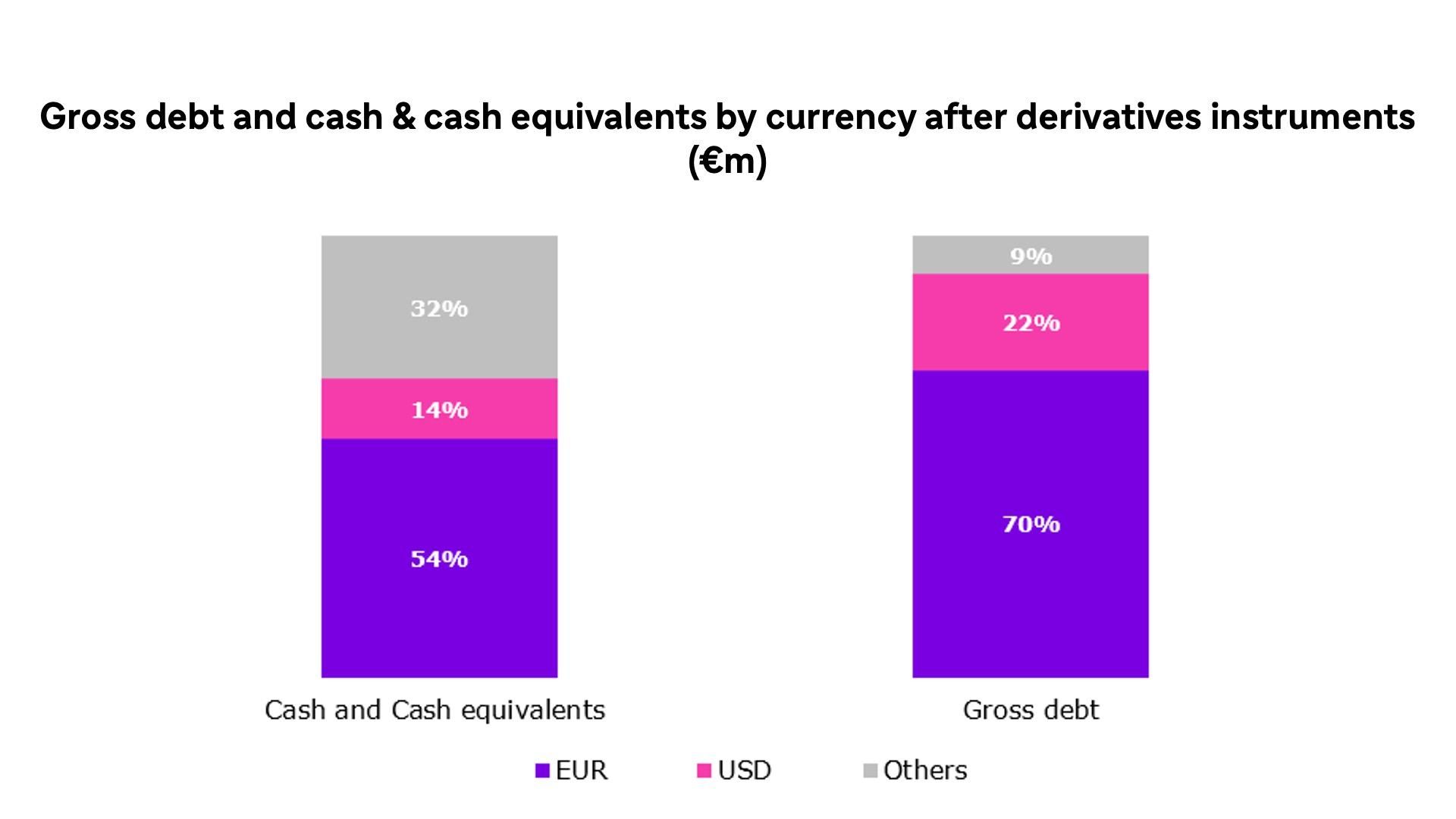

December 31, 2024: net debt of €8,772 million (gross debt of €16,137 million after derivatives minus cash and cash equivalent of €7,365 million after derivatives)

Net debt is a non-GAAP measure

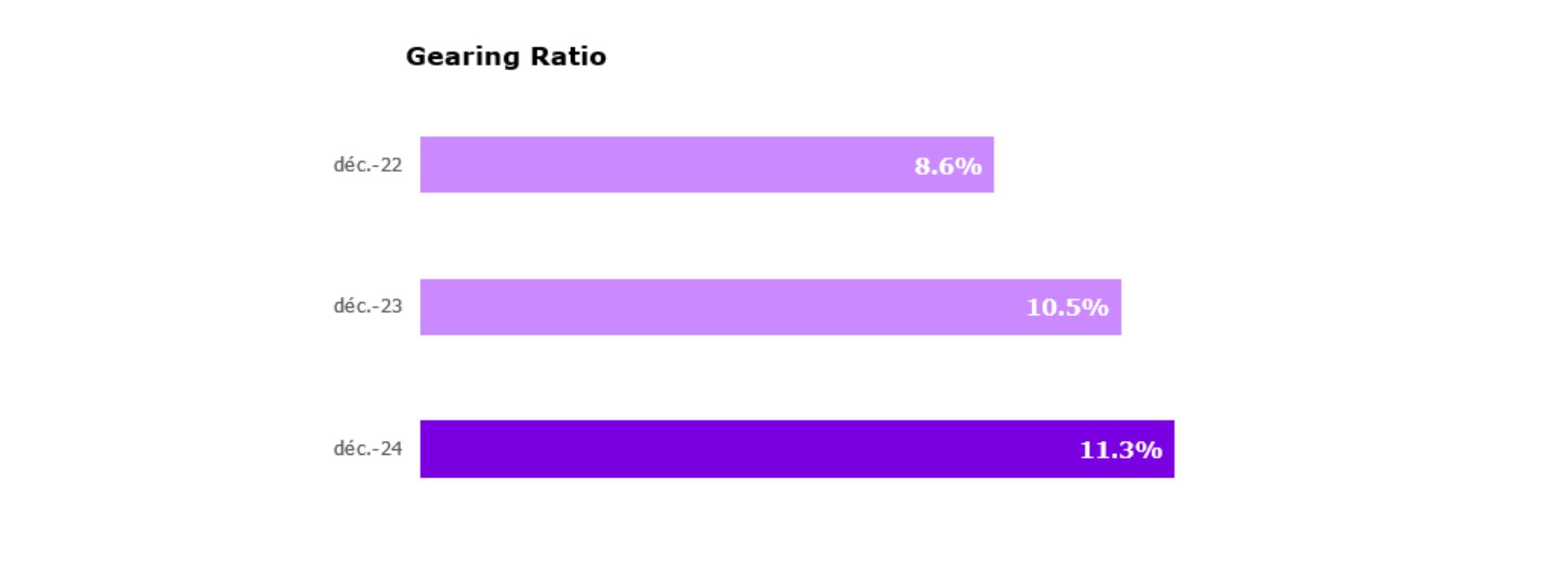

Gearing ratio: Debt, net of cash and cash equivalents, to total equity

*With effect from January 1, 2019, the first-time application of IFRS 16 means that lease liabilities are not included in net debt.

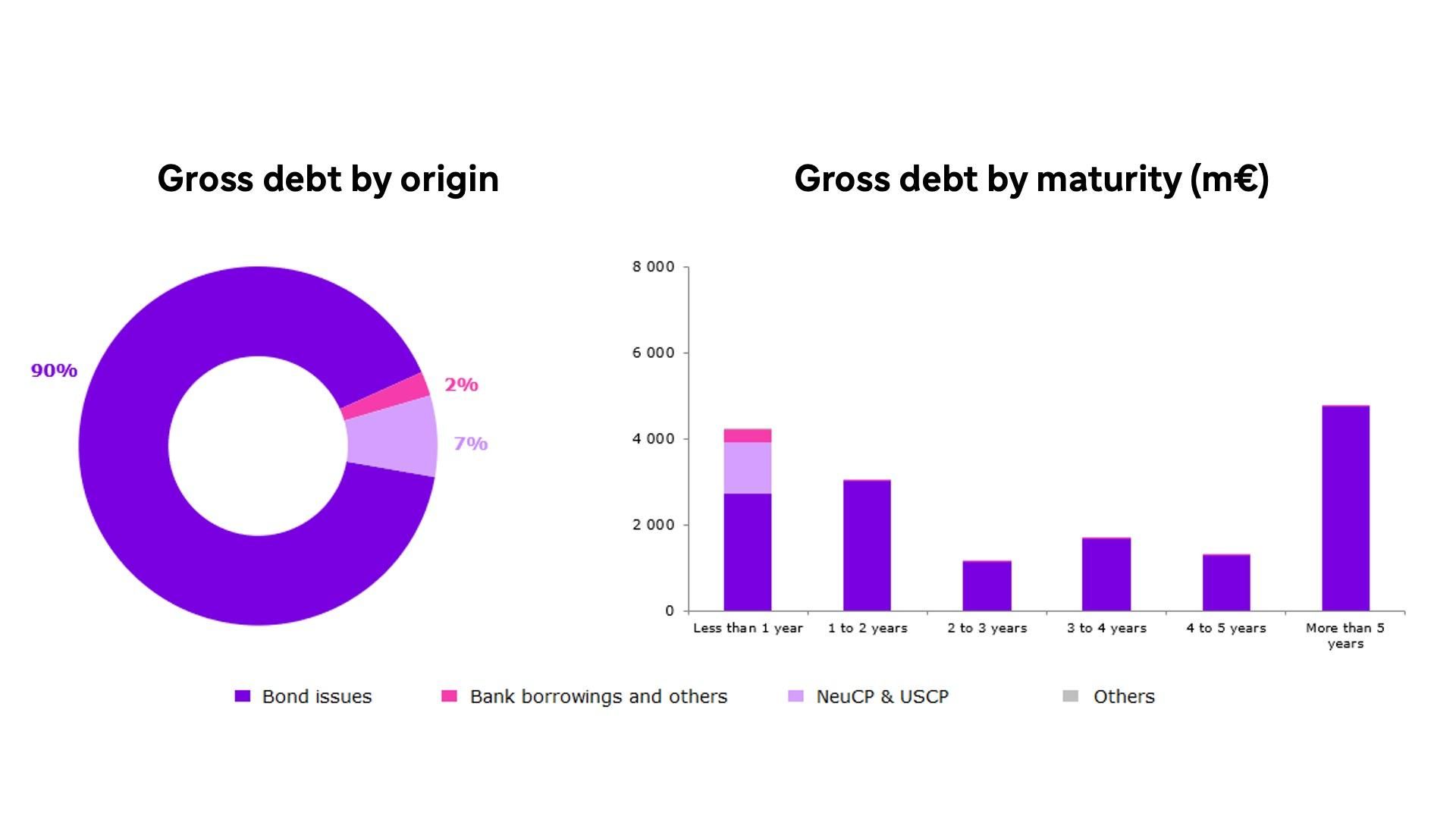

Gross debt structure at value on redemption as of December 31, 2024

Credit ratings

Credit ratings assess the credit worthiness of the Company and its ability to pay its debt.

Sanofi is followed by three credit rating agencies:

Financing instruments

Public debt programs

EMTN Euro Medium Term Note (EMTN)

Program size : €25 billion

Implemented in June 28, 2023

SEC Shelf Registered

Program size : Not specified

Implemented in April 04, 2024

NeuCP Program (Negotiable European Commercial Papers)

Program size : €6 billion

Implemented on : June 12, 2025

USCP Program (US Commercial Papers)

Program size : $10 billion

Implemented in December 22, 2004

Outstanding bonds

Notes:

-

Private placements are not included in this list

- Before derivative instruments